A new government report reveals the fundamental flaw in the American economy

A little-noticed report by the non-partisan Congressional Budget Office (CBO) released this month reveals why, for most Americans, the economy is broken. The report focuses on the American economy from 2019 to 2021. That period included a massive economic disruption due to the pandemic and a recovery as the economy reopened.

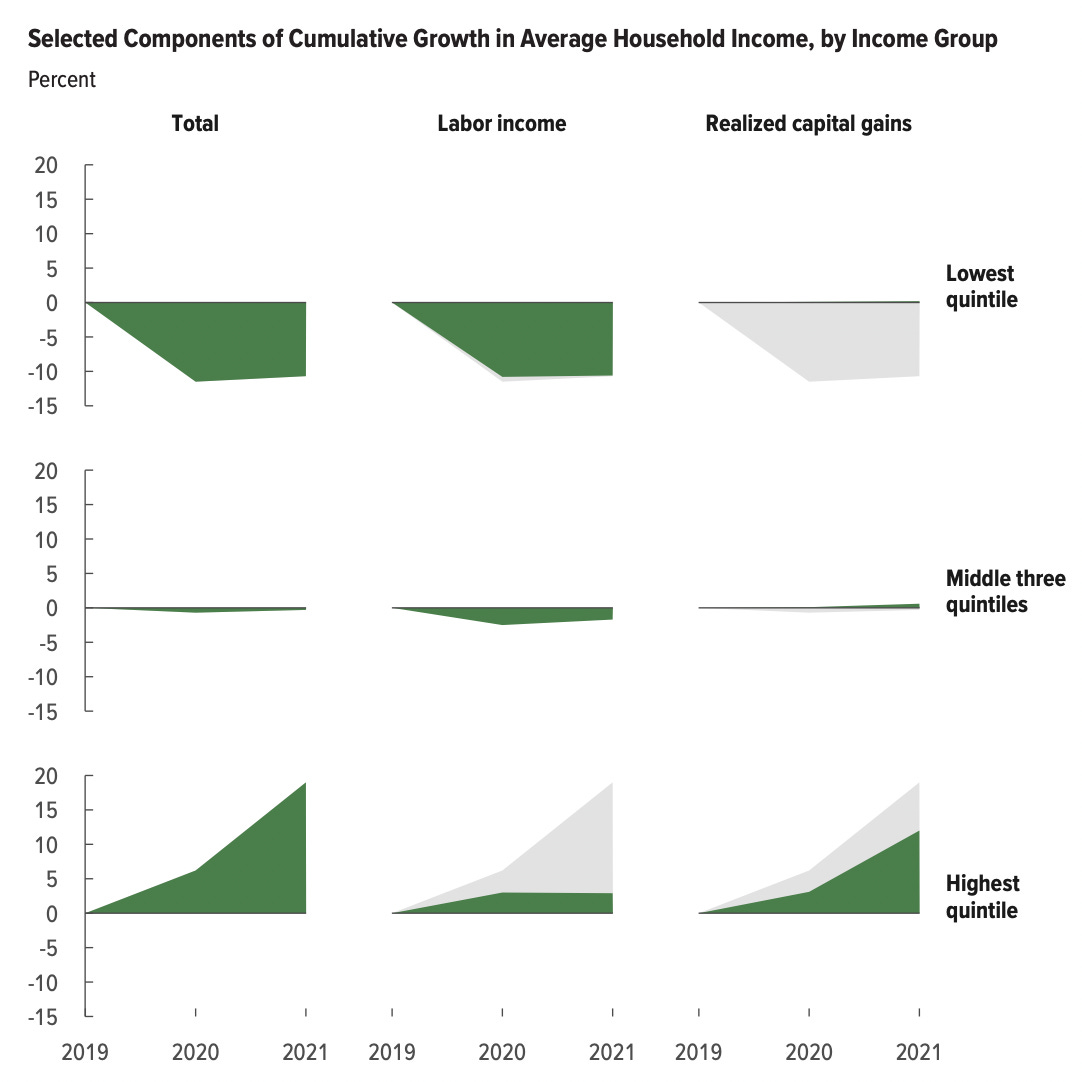

The report reveals that the economic impact of the pandemic was concentrated among the bottom 20% of earners. That group saw a significant decrease in labor income in 2020, which did not rebound as the economy reopened in 2021. The middle 60% of earners largely treaded water between 2019 and 2021 with little change to labor income or realized capital gains (which is the income generated from the sale of stock or other investments). Over the same three years, however, the top 20% of earners saw increased labor income and a dramatic increase in realized capital gains.

The analysis reveals that the economic recovery following the initial onset of the pandemic was not broadly shared. It mostly reflected an increase in investment income by the wealthy. This chart understates the discrepancy because most capital gains by the wealthy are unrealized — captured in stocks and other investments that have not yet been sold and do not count as income. Collectively, the top 1% of earners hold $14.5 trillion in unrealized capital gains.

Further, the gains did not benefit the top 20% of earners equally. Most benefits flowed to the top 1% of earners, particularly the top 0.1%.

According to an analysis by Americans for Tax Fairness, while "the average family in the bottom 90% earned just $3,100 of capital income in 2021, the average member of the top 1% received $1.6 million."

One silver lining is that, during this period, the government assisted lower-income Americans with unprecedented government transfers and tax benefits. This allowed the bottom 20% to keep their heads above water and increase or maintain their income during pandemic lockdowns.

Even so, income inequality increased. "[D]espite the reductions in inequality stemming from means-tested transfers and federal taxes, [inequality] was still higher in 2021 than in any other year since 2012," the CBO reported.

And the government benefits were temporary. Most of the pandemic-related government programs expired in 2021. So many Americans found themselves worse off as the economy returned to normal.

"Rewarding work"

With the exception of two years following the onset of the pandemic, the trend in American politics has been to oppose government support programs, even for poor children, because they discourage people from working. For example, Senate Republicans blocked a bipartisan bill to temporarily expand the child tax credit over "concerns that the legislation would disincentivize work."

But the CBO report reveals a more systemic feature of the economy that disincentivizes work. As the economy grows, most of the benefits accrue not to people that are working, but to people that happen to already have money. Average household income, before taxes and transfers, increased by about $12,000 between 2019 and 2021. But most of that money went to investors in the form of capital gains. Labor income across all income levels barely budged.

This reflects a severe power imbalance that has become a defining feature of the American economy. Large employers are responsive to shareholders, who demand companies spend billions on stock buybacks and reduce labor costs to increase share prices. But workers are viewed as replaceable — or considered "independent contractors" — and have little to no sway. The fact that the workers' labor is responsible for producing the profits is not a factor.

40 years of economic stagnation

Taking a longer view, government actions from 2019 to 2021 did little to change the fundamental reality of the American economy. For more than 40 years, economic growth has mostly benefited the wealthy.

The so-called "welfare state" is doing little to ameliorate this trend. The charts tracking the average income by quintile before and after "transfers and taxes" look nearly identical.

In inflation-adjusted dollars, the average income for the top 1% of earners in 1979 was $618,100. In 2021, the average income for the top 1% was $3,110,500. The bottom 90% experienced much more modest growth. In 1979, the average income of the bottom 90% of earners was $52,080. In 2021, the average income for the bottom 90% was $73,310.

All of these statistics help explain the disconnect between broad economic indicators and the subjective view of the economy among Americans. Currently, unemployment is low, inflation has cooled, and the economy is growing.

Still, a Harvard CAPS poll released earlier this month found that "63% of voters believe the U.S. economy is on the wrong track and 62% characterize it as weak." People may have jobs. But, for many, those jobs are not helping them get ahead. Meanwhile, people watch the fruits of their labor flow to the already wealthy.

Reagan ushered in supply-side economics. He didn't author the plan (called voodoo economics by the elder Bush) but was happy to implement it. And, while suggested as an approach to top-down economics, it had its actual desired effect: making the wealthy even more wealthy. And Reagan started cracking down on unions, so rural blue collar workers no longer earned a nice living wage from the auto industry, etc. The wealthy moved their manufacturing factories out of the country. And, with real estate speculation driving up home prices and rent, rural blue collar workers fell further and further behind. The RW blamed this, falsely of course, on Dem policies and immigrants taking the good jobs. This led to the current anger and the rise of Trump. And now the wealthy like Koch, the NRA bosses, Murdock and others use cultural warfare - guns, immigrant anger, LGBTQ+ - to deflect from the work done by the uber-wealthy to destroy the financial life of rural Americans. And they fall for it, hook, line and sinker, though Dem economic policies are much better for workers.

Without progressives, this country would have not a single safety law. We'd be a country of serfs, working for pennies as our "medieval" masters accumulated power, wealth and property. An exaggeration, of course, but not so far-fetched.

32 of 33 civilized countries have universal health care. All except for us, who has the lowest life expectancy by far. Unfettered capitalism is what the wealthy want and scream socialism every time something is done to level the playing field. Socialism. Another word that resonates with angry rural Americans, who somehow believe the pot of gold is around the corner if not for immigrants, non-whites and the like.

Let's not blame the rich for anything. Let's fight over our 10 percent of the pie while the rich keep their 90 percent. The gullible are good with this.

Some of the Republicans who voted against expanding the child tax credit on the basis that it would "disincentivize work" probably wish we'd go back to the days of kids laboring in factories and mines. What a bunch of ghouls.