Decisions have consequences

A core component of President Biden's failed Build Back Better plan was the extension of the expanded child tax credit. The American Rescue Act, which was signed into law in March 2021, expanded the child tax credit for one year. The credit was expanded in three ways:

1. The amount of the child tax credit was increased from $2,000 per child to $3,600 for each child 5 or younger and $3,000 for each child 6-17. (The credit phased out for couples making $150,000 or more and individuals making $75,000 or more.)

2. From July to December 2021, credits were sent to eligible families as a monthly benefit, instead of forcing families to wait for a tax refund.

3. The child tax credit was made fully refundable regardless of income. Previously, millions of families missed out on some or all of the tax credit because they made too little money.

Biden initially proposed extending the expanded child tax credit until 2025. When Senator Joe Manchin (D-WV) and other Democrats objected to the overall size of the bill, Biden proposed extending it one year. The cost of extending the child tax credit varies depending on exactly how it is implemented, but costs around $100 billion per year.

There were various proposals to offset the cost of the expanded child tax credit and other provisions in Build Back Better. One proposal that gained traction for a time was a billionaires' tax. That proposal, championed by Senator Ron Wyden (D-OR), would have imposed a 23.8% tax on the unrealized gains of extremely wealthy people. Currently, billionaires are able to accumulate massive wealth without paying taxes by never selling their stocks. They borrow against their assets whenever they need cash. This tax avoidance strategy has a name: buy, borrow, die.

The new tax would have only applied to "individuals with at least $1 billion in assets or $100 million annual income in three straight taxable years." Wyden estimated it would have impacted just 700 people. Wyden's proposal would have raised $507 billion over 10 years, more than enough to offset a four-year extension of the expanded child tax credit. $275 billion would have come from the ten richest billionaires.

Ultimately, however, the proposal was dropped due to opposition from Manchin and a few other Democrats. "I don’t like the connotation that we’re targeting different people," Manchin said. There were other proposals, including a 5% surtax on income over $10 million and an 8% surtax on income over $25 million. That would have raised about $230 billion over ten years, more than enough to cover the one-year extension of the expanded child tax credit.

None of this, however, was enough to win over Manchin, Senator Krysten Sinema (D-AZ), or any of the 50 Senate Republicans. Instead, Manchin, Sinema, and the Senate Republicans decided not to increase taxes on billionaires and have the expanded child tax credit expire on December 31, 2021. That decision has had immediate consequences.

3.7 million children fall into poverty

As a result of the decision to let the expanded child tax credit expire in December, 3.7 million children fell into poverty, according to a study by the Center on Poverty and Social Policy. The child poverty rate increased from "12.1 percent in December 2021 to 17 percent in January 2022" — a 41% increase.

The monthly payments, which have now stopped, were spent "on basic household needs and children's essentials: the most common item is food." The payments were effective in meaningfully reducing "family food insufficiency, particularly among children in families with low and moderate incomes." After the July payment alone, "food insufficiency rates among families with children dropped by 24 percent." After two months of payments, "2 million fewer adults report[ed] that their children, specifically, did not have enough to eat."

Other top categories for spending the child tax credit payments were bills, clothing, rent, and school expenses. According to a September 2021 survey by the American Enterprise Institute, 62% of families "across all income levels said the Child Tax Credit was 'somewhat important or very important' or meeting day-to-day expenses."

Children living in poverty experience "hunger, illness, insecurity, instability" on a daily basis and are also "more likely to experience low academic achievement, obesity, behavioral problems and social and emotional development difficulties" over time.

The 15 richest billionaires are now worth $1.5 trillion

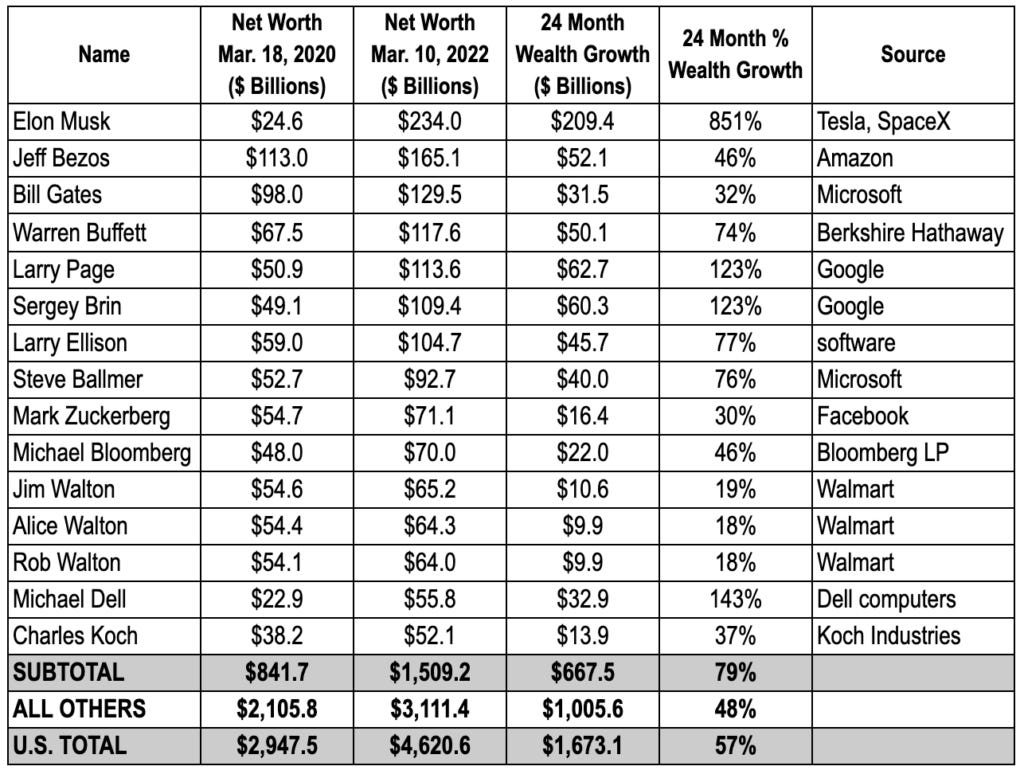

The failure to pass a billionaires' tax has allowed the nation's richest people to accumulate even more wealth with little to no taxation. According to a new report from Americans for Tax Fairness, the 15 richest billionaires are now worth more than $1.5 trillion dollars. The wealth of this group has increased 79% ($668 billion) since the start of the pandemic two years ago.

Tesla CEO Elon Musk, for example, saw his wealth increase from $24.6 billion to $234 billion in the last two years. If the billionaires' tax had passed, he would have owed about $50 billion, which would reduce his net worth to $184 billion. He would still be the wealthiest person in the world and his contribution would have paid for half of the expansion of the child tax credit for 2022.

There are now 704 American billionaires. They are currently worth, collectively, $4.6 trillion. Their total increase in wealth in the last 24 months ($1.7 trillion) would be enough to extend the expanded child tax credit for 16 years.

This outcome was not an accident. Rather, many of America's billionaires are current or former executives at companies represented by prominent lobbying groups, including the U.S. Chamber of Commerce and the Business Roundtable. These lobbying groups spent millions to defeat the Build Back Better proposal. Their goal was to stop tax increases on billionaires and corporations.

The U.S. Chamber of Commerce specifically argued against extending the expanded child tax credit, saying it was concerned about "large amounts of transfer payments that are not connected to work."

Corporate lobbyists won the day. And now 3.7 million children are in poverty.

Thank you for writing.

The various policy initiatives from stimulus to child tax credits benefited my family immensely.

A compromise to consider with regards to wealth tax. Tax stagnant and leveraged wealth at 50%. Offer a credit for domestic investment with tangible requirements such as return, projected return, equity and climate considerations.

Any middle class person complaining of big government should be asked if they considered returning the funds received through stimulus, increased tax credits, and sustained jobs through the PPP initiative.

The Main Street American was starting to get their bailout. They just aren’t sophisticated enough yet to understand how.

Subscribing because you get results! Thank you.