Tesla, as a publicly traded company, does not exist to serve the interests of Elon Musk, its CEO. Rather, it must act in the interests of all its shareholders.

The electric car company ran into some trouble in this regard when it agreed to a massive compensation package for Musk in 2018. The deal resulted in Musk being awarded more than $50 billion in stock options, which, combined with his existing shares of Tesla and other assets, made him the richest person in the world.

Musk's pay was approved by the board of directors and a vote of shareholders. It also required Musk to meet ambitious growth and profitability targets. But in January, Delaware Chancery Court Chief Judge Kathaleen McCormick invalidated the whole thing. In a 201-page decision, McCormick sided with Tesla shareholders challenging Musk's pay. She found that the company's board of directors breached their fiduciary duty by granting Musk excessive compensation and failing to be transparent with shareholders.

McCormick noted that the scope of Musk's pay package was unprecedented — "250 times larger than the contemporaneous median peer compensation plan and over 33 times larger than the plan’s closest comparison, which was Musk’s prior compensation plan." Further, Musk enjoyed "thick ties with the directors tasked with negotiating on behalf of Tesla, and dominated the process that led to board approval of his compensation plan."

Ira Ehrenpreis, who chaired the compensation committee, is a longtime friend of Musk who has invested tens of millions in Musk's companies and bought the first Tesla Model 3. Another committee member was Antonio Gracias, a friend and business associate who regularly vacations with Musk. The shareholders who sued to void Musk's pay package noted that these board members were described to shareholders as "independent" prior to the vote on Musk's pay. (Another Tesla board member is Musk's brother, Kimball.)

Tesla General Counsel Todd Maron, "Musk’s former divorce attorney… whose admiration for Musk moved him to tears during his deposition," also played a key role in the process. But the reality was that there wasn't much of a process at all. Musk proposed the amount and structure of his pay, and the board approved it. During the legal proceedings, Gracias admitted there was no "positional negotiation."

How has Tesla's "independent" board responded to a mortifying legal defeat? Has it proposed changing its governance structure to create genuine independence from Musk? Has it proposed a more reasonable level of compensation for its CEO? Nope. Instead, the board voted to award Musk the exact same pay package a court just decided was unfair, retroactively. And now, they are asking Tesla's shareholders to approve the plan on June 13 — or early by proxy vote.

The Tesla board has created a dedicated website, SupportTeslaValue.com, to encourage shareholders to give Musk $50 billion. Originally, the pay package was supposed to incentivize Musk to work hard for the company. This never made much sense since Musk, at the time, already owned more than 20% of the company and was incentivized for Tesla to succeed. Before the 2018 compensation package, every time Tesla's value increased by $50 billion, Musk earned $10 billion.

Now, this argument makes even less sense because the company is compensating him for work that has already been done. So, the board chair Robyn Denholm asks shareholders to approve Musk's pay package reactively as "a matter of fundamental fairness and respect to our CEO."

Denholm, who became board chair in 2018, is incentivized not to rock the boat. In 2021 and 2022, Denholm cashed out over $280 million in Tesla stock options. She described the wealth she has achieved at Tesla as "life-changing." Meanwhile, the "average total compensation for board members in the largest 200 U.S. companies was $329,351 in 2023."

It's a team effort. On X, Musk is rallying his supporters to approve his massive pay package.

2024 is not 2021

In the company's proxy statement, Tesla urges current shareholders to retroactively award Musk $50 billion to recognize the "stockholder value" that Musk delivered as CEO. But not all current Tesla shareholders have benefited from Musk's leadership. On November 5, 2021, the price of one share of Tesla stock was $407.36. Current shareholders who bought their stock that day have lost nearly 60% of their investment. Since the beginning of the year, Tesla stock has lost almost 30% of its value. Musk himself has unloaded about $39 billion in shares.

Musk would not be entitled to his full compensation package based on the company's current valuation. He was awarded about 1% of Tesla's outstanding stock each time the company's value increased by $50 billion, up to $650 billion. Tesla's current market value is less than $550 billion. The Tesla board voted to compensate Musk as if the company was still worth $650 billion.

Tesla's future prospects are also much less rosy than three years ago. Global demand for electric vehicles is slowing, and Tesla faces increased competition from nearly every global automaker. Tesla's core vehicle lineup is dated. And its one new entrant, the CyberTruck, has been a bust. Plans to build a less expensive model, seen as a key to future growth, were scraped. In the first quarter of 2024, Tesla reported "its first year-over-year decline in quarterly deliveries since 2020."

Musk's embrace of far-right politics and bigoted conspiracy theories appears to have damaged Tesla's brand. Today, just 31% of people in the United States would consider buying a Tesla, down from 70% in November 2021.

Increasingly, Musk is staking the company's future on his plan to make Tesla's fully autonomous. The "Full Self Driving" product currently "requires drivers to pay attention at all times and doesn’t make cars autonomous." Musk first claimed that Teslas would be fully self-driving in 2016. Since then, he's repeatedly announced that his vision was just around the corner but failed to deliver. In 2019, for example, he said that Tesla robotaxis would begin operating in 2020.

Tesla "forecasted the robo-taxis would last 11 years, drive 1 million miles and make $30,000 gross profit per car annually." At the time, Musk said it was "financially insane to buy anything other than a Tesla."

Now, Musk is promising a robo-taxi by August 8.

But robo-taxis already exist — they just aren't operated by Tesla.

Musk is also hyping Tesla's Optimus robot, claiming it "will be able to perform useful tasks in the factory by the end of the year and could reach the market by the end of 2025." Musk says the Optimus is "more valuable than everything else [at Tesla] combined." One analyst called Musk's claims about Optimus "utter nonsense and borderline investor fraud."

$50 billion is not enough

Denholm says Tesla stockholders should give Musk $50 billion so Musk "will continue to be driven to innovate and drive growth at Tesla." Today, running Tesla is not Musk's full-time job. He is also CEO at SpaceX (his privately held aerospace company) and CTO at X. Musk also helps run xAI (his artificial intelligence company), Neurolink (which recently implanted a microchip into someone's brain), and the Boring Company (which makes tunnels for transportation).

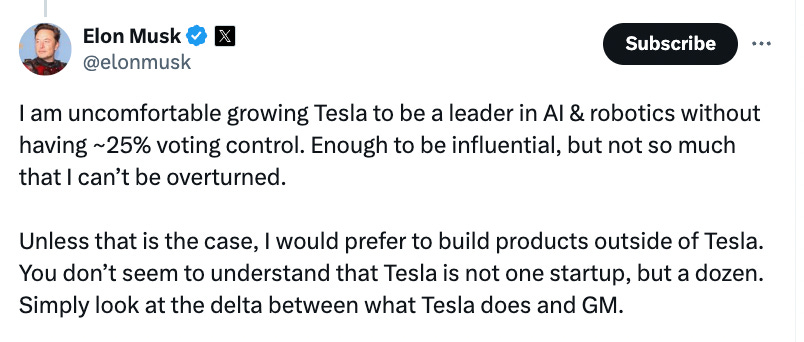

And Musk has already made clear that restoring his $50 billion pay package isn't enough to keep him interested in Tesla. Musk said he is "uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control."

To achieve that, the Tesla board and shareholders, after giving Musk $50 billion, would need to provide Musk with another massive stock grant. And, unlike in 2018 when the compensation package was tied to future growth targets, Musk appears to be demanding an immediate increase in his ownership without conditions. Musk would own more stock currently but sold a significant portion of his holdings to finance his acquisition of Twitter.

Almost all shareholder resolutions proposed by the company are approved. But whether or not Delaware courts will allow the reinstatement of Musk's 2018 package — or an even larger future compensation package — is far from certain. So, in addition to a $50 billion payment to Musk, the Tesla board is also proposing to move Tesla's state of incorporation to Texas. In her message to shareholders, Denholm says "the board and I are increasingly troubled by the growing uncertainty of Delaware corporate law." But "we believe that the Texas legal system is strong and fair."

Denholm does not mention that she and other board members were sued in Delaware for awarding themselves excessive compensation and agreed to a settlement where they "collectively agreed to return more than $735 million to the electric car maker's coffers in combined options, cash and stocks." Denholm and the other board members did not admit to any wrongdoing.

Unbelievable. It’s astounding that so much of the world’s wealth is hoarded by just a handful of greedy individuals. I wouldn’t drive a Tesla if you paid me. A friend of mine has one … she has a bumper sticker on it that says “I bought this before I knew he was an asshole.”

Go ahead and pay Musk the $50 billion — but then tax it at 90% so he has to pay $45 billion to the IRS. That's nearly enough to give Medicare to every person including the currently uninsured health coverage.

Then make that the permanent tax rate on all income > $1 billion. That could possibly snag some more money from people who can afford it. Hell, they won't even miss it.