How Ticketmaster gets away with it

As the pandemic has waned, millions of Americans were excited to return to live concerts, sports, and comedy shows. The cost of attending an event, however, has exploded. Yes, the face value of these tickets has gone up considerably. But an even bigger problem is "fees," which can be "as high as 75% of the ticket price." Worse, consumers are increasingly forced to buy tickets on the secondary market, where prices and fees are even higher.

These issues can be traced back to one company: Live Nation Entertainment.

In 2010, Ticketmaster was already a dominant player in the primary ticketing market. But that year, the Department of Justice approved a merger between Ticketmaster and Live Nation, the world's largest concert promoter and Ticketmaster's only significant competitor in the ticketing space. According to a new report by the Economic Liberties Project, the merged company, Live Nation Entertainment, is a "monopolistic company that can get away with ripping off… fans and strong-arming venues."

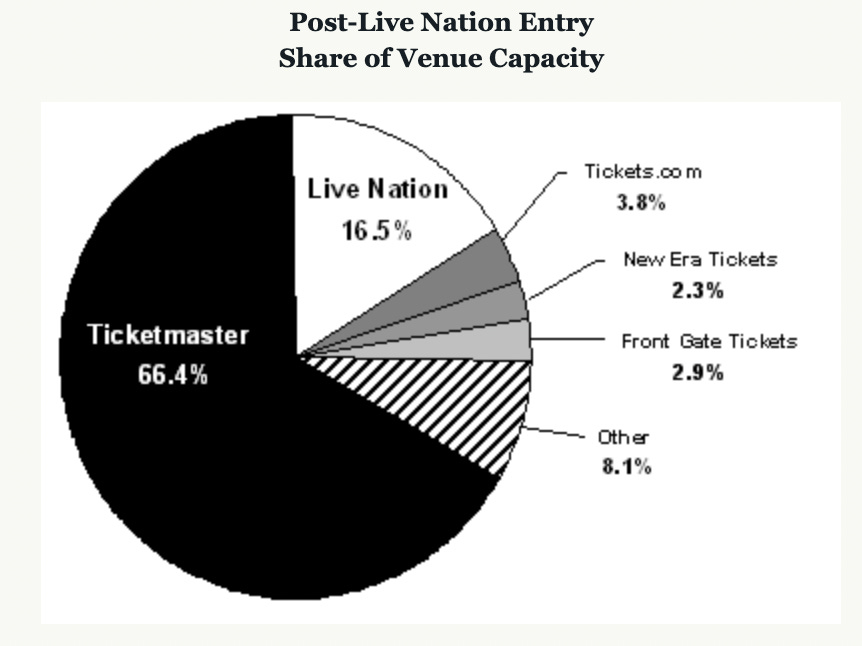

Prior to 2007, Ticketmaster controlled more than 82% of the primary ticketing market in the United States. No other company had more than a 3.8% share. At this point, Live Nation was Ticketmaster's largest customer.

In 2007, Live Nation ended its relationship with Ticketmaster. Then Live Nation launched its own service, called CTS. Live Nation began ticketing venues it managed and competing for contracts with third parties. By 2009, Ticketmaster had a 66.4% share of the primary ticketing market, and Live Nation had a 16.5% share. Other competition remained minimal.

An already dominant market player merging with its only real competitor would seem like a red flag for antitrust officials. And there were other concerns. Specifically, the merged company could use Live Nation's relationship with hundreds of popular acts, from Miley Cyrus to U2, to pressure venues to use Ticketmaster's services.

Nevertheless, the Department of Justice's Antitrust Division signed off on the merger with a few minor conditions. Ticketmaster was required to sell a small ticketing subsidiary, Paciolan, to Comcast. (Paciolan remains a tiny player in the ticketing market.) Live Nation Entertainment also had to promise not to "retaliate against any venue that considers or works with another primary ticketing service." These and a few other requirements were memorialized in a document called a "consent decree."

Live Nation Entertainment issues tickets (Ticketmaster), manages venues (Live Nation), and represents performers (Live Nation). Ticketmaster has retained more than 80% of the primary ticket market and jacked up fees. On its website, Ticketmaster emphasizes that its ticketing fees are split with "clients," which include the venues and promoters. But Ticketmaster's "clients" are often other entities owned by Live Nation Entertainment.

Ticketmaster also began selling tickets on the secondary market, where prices and fees are even larger. Ticketmaster's involvement in the secondary market gives it an incentive to allow scalpers to purchase tickets and then benefit from another round of fees and markups when they are resold. Tickets on the primary market are often limited and sell out in minutes.

AEG, one of Live Nation Entertainment's chief competitors in the overall concert business, told the Department of Justice that "venues it manages that serve Atlanta; Las Vegas; Minneapolis; Salt Lake City; Louisville, Ky.; and Oakland, Calif., were told they would lose valuable shows if Ticketmaster was not used as a vendor." In Atlanta, Matchbox Twenty, a Live Nation act, allegedly "bypassed the Gwinnett Center, a popular arena outside the city" because the venue refused to use Ticketmaster.

In 2019, the Department of Justice determined that Live Nation Entertainment had repeatedly violated the consent decree shortly after it was signed:

The United States has found that, since 2012, Defendants’ executives have retaliated against or threatened venues throughout the United States in violation of the Final Judgment’s Anti-Retaliation and Anti-Conditioning Provisions. These violations began shortly after the decree was entered in 2010 and have recurred throughout its term, with the most recent known violation occurring as late as March 2019. As a result of this conduct, venues throughout the United States have come to expect that refusing to contract with Ticketmaster will result in the venue receiving fewer Live Nation concerts or none at all. Given the paramount importance of live event revenues to a venue’s bottom line, this is a loss that most venues can ill-afford to risk. As a result, many venues are effectively required to contract with Ticketmaster to obtain Live Nation concerts on reasonable terms, limiting the ability of Ticketmaster’s competitors to compete in the primary ticketing market and harming venues that would benefit from increased competition.

But instead of suing to unwind the merger or imposing any financial penalty, the Department of Justice decided simply to make a few small modifications to the consent decree. It extended the terms of a consent decree by five years, "clarified" that Live Nation Entertainment was not allowed to threaten venues, and imposed small fines if a future violation is discovered.

These modifications provided little relief to consumers. Live Nation Entertainment was allowed to bully venues repeatedly for more than a decade with no repercussions. It had already locked in the vast majority of the market and crushed potential competitors. The revised agreement did nothing to make the market more competitive or provide any reason for TicketMaster to reduce its fees.

By all accounts, since it agreed to the modified consent decree, Live Nation Entertainment has conducted business as usual. The threat of retaliation hangs over the head of venues, and fees continue to increase. In the last two years, Live Nation Entertainment has continued to consolidate its market power, purchasing "a competing ticketing startup founded by a former Live Nation executive called Rival" and acquiring "three leading international ticketing and event companies."

Earlier this year, Senators Richard Blumenthal (D-CT) and Amy Klobuchar (D-MN) "called on the Department of Justice to investigate the state of competition in the market for live entertainment, including potential violations of Ticketmaster-Live Nation’s updated consent decree." The Senators said they were "deeply concerned that the Department’s past enforcement and negotiated remedies in this industry have failed to adequately foster and protect competition."

On Wednesday, a coalition of anti-monopoly groups — including the American Economic Liberties Project, Sports Fans Coalition, the Consumer Federation of America, and the Artist Rights Alliance — launched a campaign calling on the Department of Justice to break up Live Nation Entertainment.

Thank you for explaining this. I recently tried to buy tickets at Madison Square Garden for The 1975, a band that shouldn’t have sold out MSG in 15 minutes, but that is exactly what happened, before my eyes while I was trying to get tickets. I was baffled and deeply disappointed. I like them enough to pay face value for tickets, but not enough to pay hundreds of dollars on the secondary market. I thought it was simply bots and scalpers buying the tickets but now realize Ticketmaster is in on the scam. How depressing that an average person can no longer afford to see most live acts. I recently went to see Billy Bragg at a smaller venue. He’s a die hard socialist, so I’m sure he willfully refuses to work with Ticketmaster. Bought tickets at face value for a reasonable price, no drama. I wish more acts would look out for their fans like he does.

This is always the problem when companies get too large. They become monopolistic ventures. Judd, I had no clue that it was this bad. Only because prices are so high in general, I just don't go out to see bands anymore. It's not worth the hassle, the cost to park, eat and anything else in addition to the ticket. Hell, I've seen beer sold at $9 per cup! But this? This is capitalism run amok.