How to buy your way out of a federal lawsuit

On June 6, 2023, the Securities and Exchange Commission (SEC) filed charges against Coinbase, a crypto trading platform, alleging that the company was operating as an unregistered securities broker. The failure to register, according to the SEC, "deprived investors of significant protections, including inspection by the SEC, recordkeeping requirements, and safeguards against conflicts of interest." Meanwhile, Coinbase made billions of dollars.

Coinbase and other crypto exchanges claim they are under no obligation to register with the SEC because crypto tokens are not securities. Whether or not a crypto token is a security comes down to a legal standard is known as the Howley test. Although the analysis can be complex, in the crypto context it largely depends on whether the management of the token is truly "decentralized," like Bitcoin, or is actively managed by a team of people, like many other tokens. Coinbase offers tokens like Solana and Tether that are highly centralized.

Securities brokers that register with the SEC must meet a variety of regulatory requirements that protect consumers, like not comingling the assets of the company with customer deposits. Another prominent crypto platform, FTX, did not register with the SEC and misused deposits, costing customers billions of dollars.

Coinbase sought to dismiss the SEC lawsuit. But a federal judge rejected that argument, finding in March 2024 that the SEC's complaint "plausibly support[s] the SEC’s claim that Coinbase operated as an unregistered intermediary of securities." Since then, the parties have been battling about discovery — the process in which both parties seek information from the other to bolster their case. That process was scheduled to be completed in August 2025, although proceedings were paused earlier this year as Coinbase appeals the March 2024 decision.

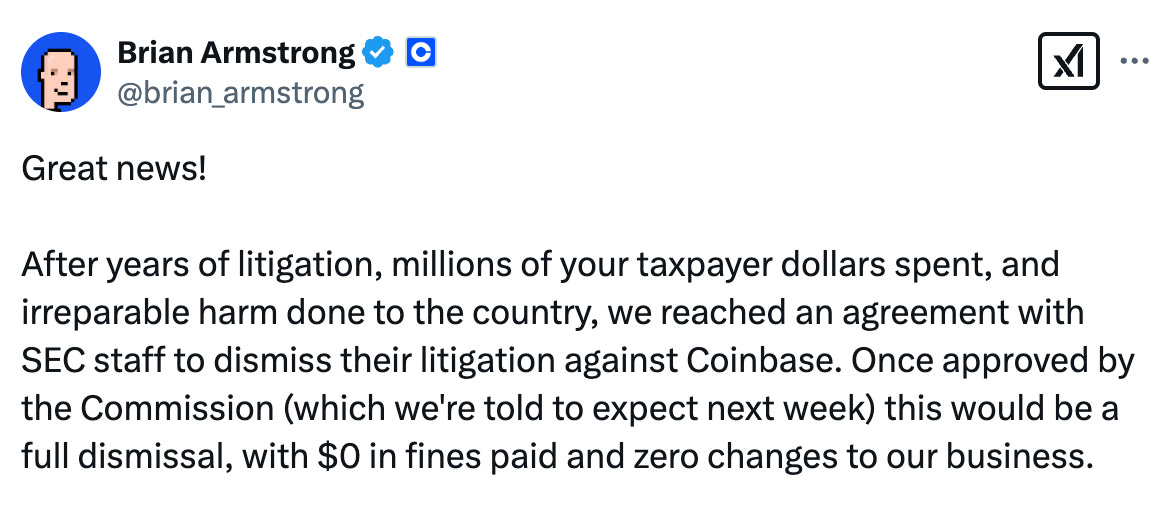

In other words, the lawsuit was a major ongoing legal problem for Coinbase. But now, according to Coinbase CEO Brian Armstrong, the case is over.

On February 21, Armstrong wrote on X that Coinbase and the SEC had "reached an agreement with SEC staff to dismiss their litigation against Coinbase." According to Armstrong, in exchange for the SEC dismissing the suit, Coinbase will pay "$0 in fines" and make "zero changes to our business."

That's quite a deal! How did Armstrong secure such an "agreement"? Follow the money.

We started a new publication, Musk Watch. NPR covered our launch HERE. It features accountability journalism focused on one of the most powerful humans in history. It is free to sign up, so we hope you’ll give it a try and let us know what you think.

During the election, Coinbase donated $75 million to Fairshake, a pro-crypto Super PAC that supported many congressional candidates aligned with President Trump. The group is also expected to play a major role supporting Republicans in the 2026 midterms. Coinbase's Chief Legal Officer, Paul Grewal, attended multiple fundraisers for Trump, including a high-profile event in San Francisco hosted by venture capitalist David Sacks.

Coinbase also launched the "Stand with Crypto Alliance," which graded politicians. Trump received an "A." (Former Vice President Kamala Harris was not assigned a grade.)

Shortly after the election, Armstrong met privately with Trump at Mar-a-Lago.

In December, Coinbase donated $1 million to Trump's inauguration celebration. Coinbase also co-sponsored an "unofficial inaugural ball on Friday at the Andrew W. Mellon Auditorium in downtown Washington," which featured Snoop Dogg. Then, "Coinbase Global Chief Executive Brian Armstrong attended a black-tie dinner on Saturday hosted by Vice President-elect JD Vance at the National Gallery of Art while a group of other executives went to a Sunday dinner hosted by Trump," the Wall Street Journal reported.

In January, Coinbase hired Chris LaCivita, the co-manager of Trump's campaign, to be a member of its Global Advisory Council. According to Semafor, LaCivita will use his familiarity with "Trump’s network to help the industry navigate this Congress and beyond." Coinbase did not disclose how much it is paying LaCivita. "The crypto industry deserves better than what it received from the previous administration," LaCivita said.

Coinbase also helped personally enrich Trump, quickly listing his official meme coin, $TRUMP, on its platform. The Coinbase listing made it much easier for the average investor to purchase $TRUMP, driving up its value. Most $TRUMP coins are owned by Trump himself.

Trump also collects trading fees each time a $TRUMP coin is sold. One Coinbase executive recently estimated Trump and his associates had made at least $58 million in trading fees. $TRUMP is a heavily centralized token that would almost certainly be considered a security under existing legal precedent.

In his post on X announcing the end of the SEC's lawsuit, Armstrong characterized the decision as a political move by Trump. "I have to give credit here to the Trump administration, for winning the election," Armstrong wrote. "I feel confident we would have won this case in the courts either way, given our facts were so strong, but it certainly helped accelerate the process and drive accountability."

How to get rich doing illegal activity?

Make it legal. When you own the law it is easy.

Nothing to see here. These aren’t the frauds you are looking for. Move along.