How Trump Media collapsed

Trump Media and Technology Group (TMTG), the parent company of Truth Social, has an unrivaled free source of publicity. President Trump, who is also TMTG’s largest shareholder, posts extensively on the Truth Social platform, sometimes dozens of times in a single day. He is essentially leveraging the full weight of the presidency, the world’s most powerful office, to drive awareness of TMTG’s offerings.

Yet, by all objective metrics, TMTG is failing.

The stock price, which trades under the ticker symbol DJT, peaked at nearly $62 in March 2024, shortly after the company went public through a merger with a special purpose acquisition company (SPAC). On February 17, DJT stock closed below $10 per share, an all-time low. (It rallied modestly on Wednesday, closing at $10.48.)

What happened?

First, the fundamentals of the business are poor. In the three months ending September 2025, the most recent quarterly data available, TMTG reported $972,000 in revenue and a net loss of $58.4 million. The business is burning money at an alarming rate and has done so since its inception. It has never brought in more than $4 million per year while losing hundreds of millions of dollars.

TMTG’s core business, Truth Social, has remained tiny despite Trump’s frequent promotion. SimilarWeb estimated Truth Social had around 359,000 daily active users in 2025. Its top competitors, X and Threads, each have more than 100 million daily active users.

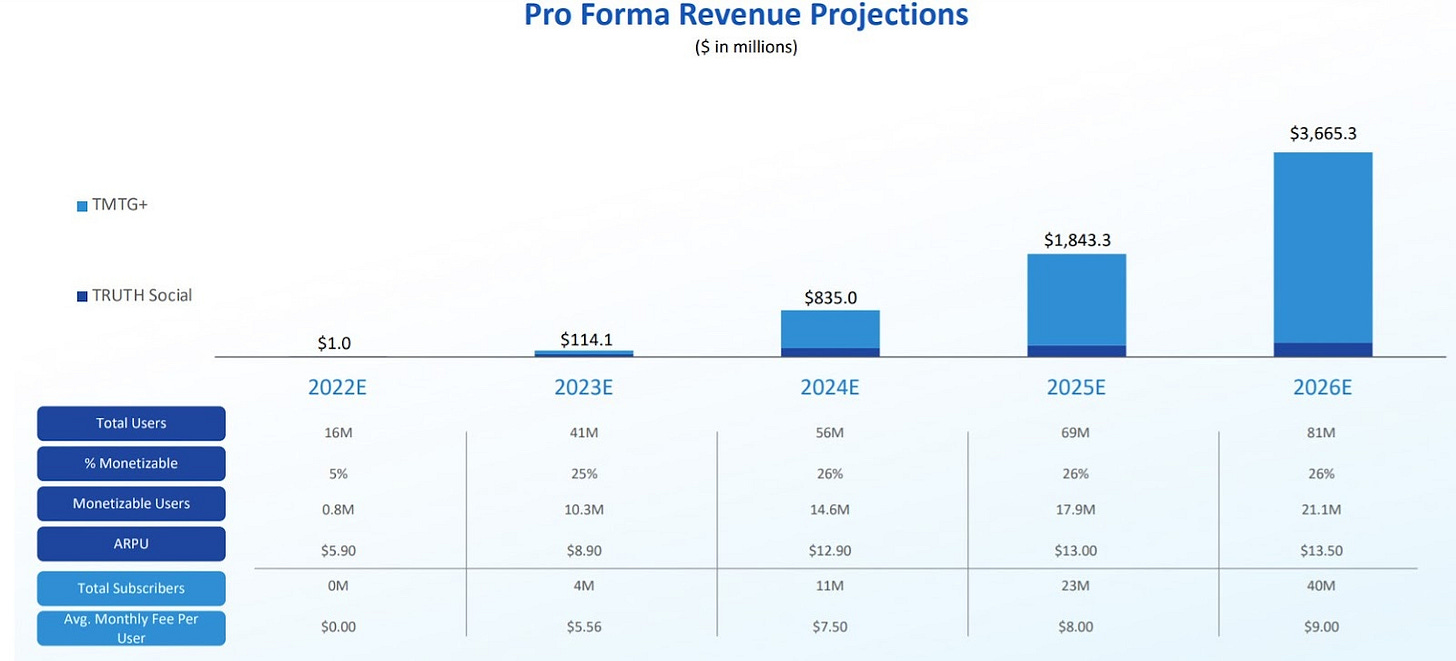

In its 2021 pitch deck to investors, TMTG projected it would have $1.8 billion in revenue in 2025 and 69 million users on Truth Social. It also estimated that it would have 23 million paid users of its TMTG+ video streaming service.

TMTG has launched a video streaming service, Truth+, but most content is available for free. The company has not disclosed how many people have subscribed to its $9.99 premium service. The same pitch deck projected 2026 revenue would double to $3.67 billion

With its core business stagnant, TMTG has sought to diversify its business to prop up its stock price. Its biggest swing came in May 2025 when TMTG announced it was raising $2.5 billion to buy Bitcoin and Bitcoin related securities. The goal was to transform TMTG into a bitcoin treasury company, tying DJT stock to the price of bitcoin, rather than the performance of Truth Social and other business activities.

TMTG executed this strategy by issuing 55.8 million new DJT shares, which diluted the value of existing stock, and issuing $1 billion in zero interest convertible notes.

This turned out to be a massive mistake. By December 2025, TMTG had purchased 11,542 Bitcoin at an average price of $108,000. The price of Bitcoin has since collapsed to about $67,000, generating an unrealized loss of about $472 million.

Beyond buying Bitcoin, TMTG has expanded into a number of other industries with little or no connection to social media.

“America First” investment products

In January 2025, TMTG announced the launch of Truth.Fi, through which it would offer various financial services. Through Truth.Fi, TMTG has created exchange traded funds (ETFs) with themes that match Trump’s political agenda — “Made in America,” “America First,” and “Bitcoin Plus.” It has also offered separately managed accounts (SMAs), a more bespoke investment vehicle for high-net worth individuals. These were pitched by TMTG and its partners as not just as an investment vehicle but as “a declaration of support for businesses essential to our economy, national security, and enduring freedoms” and an endorsement of “America First principles.”

Whether Truth.Fi’s ETFs and SMAs will meaningfully contribute to TMTG’s revenue remains to be seen. The ETFs only launched in 2026 and face competition from countless other investment vehicles.

The Crypto.com partnership

In September 2025, TMTG announced that it would offer Crypto.com’s Cronos tokens (CRO) as rewards for engagement on Truth Social. As part of the announcement, TMTG purchased 684.4 million CRO at a price of 15.3 cents per token. CRO tokens now trade at about 7.8 cents, creating an unrealized loss of over $51 million.

Crypto.com and TMTG also announced a plan to create a separate company, Trump Media Group CRO Strategy, Inc., that would hold billions in CRO tokens. With the price of CRO collapsing, the new company has not yet come to fruition. TMTG is also partnering with Crypto.com to create a prediction market, similar to Kalshi and Polymarket, called Truth Predict. It has not yet launched.

Under the Biden administration, Crypto.com was under SEC investigation. The Trump administration dropped the inquiry, and shortly thereafter Crypto.com became TMTG’s most important business partner.

The nuclear fusion tie-up

TMTG’s wildest move came in December 2025, when it announced a merger with TAE Technologies, a nuclear fusion company. The deal is valued at $6 billion and is expected to close later in 2026.

After an initial bump in the share price, investors appear to have cooled on the idea of merging a failing social media company with an energy company focused on speculative technology. The deal has raised practical concerns — no one has successfully produced energy using nuclear fusion at scale — and ethical ones. Nuclear fusion will likely need extensive support from the federal government to become viable.

Trading at an all-time low, TMTG still has an absurdly high valuation

Even at around $10 per share, TMTG still has a market capitalization of $2.9 billion. DJT stock is buoyed by retail investors who view it as a proxy for support for Trump himself. It also benefits from investor conviction that TMTG, given its relationship with Trump, will find a way to succeed. Its performance to date, however, has done little to validate that conviction.

The core problem with Trump Media is obvious - Trump. Contrary to the carefully cultivated lie that he is a great businessman, Trump has never been more than a conman and a fraud good at one thing, getting rubes (no matter how wealthy) to give him money. Since they never seem to learn, we must assume that the "investments" are better labelled as what they are "bribes" or "extortion".

"The fundamentals of the business are poor."

Who could have foreseen this? Absolutely stunning coming from the same brilliant mind behind Trump Steaks and Trump University.