Taxing our patience

Welcome to the free weekly edition of Popular Information, a newsletter with original research and fresh insight into the political news that matters most — written by me, Judd Legum.

As a free subscriber, you've been missing some great stuff: Ivanka's family leave scheme, the voter purge in Texas, and more.

Upgrade to a paid subscription and get Popular Information four times per week. It's just $6 per month or $50 for an entire year.

Since Popular Information launched in July 2018, it has demonstrated the ability to hold the powerful accountable and create change — from Tucker Carlson to Steve King to Cindy-Hyde Smith to the election fraud scandal in North Carolina.

Contact me with any questions at judd@popular.info.

Taxing our patience

By retaking the House, Democrats gained the ability to bring some accountability and transparency to the Trump administration. But they are proceeding with inexplicable caution.

Exhibit 1: Trump's tax returns.

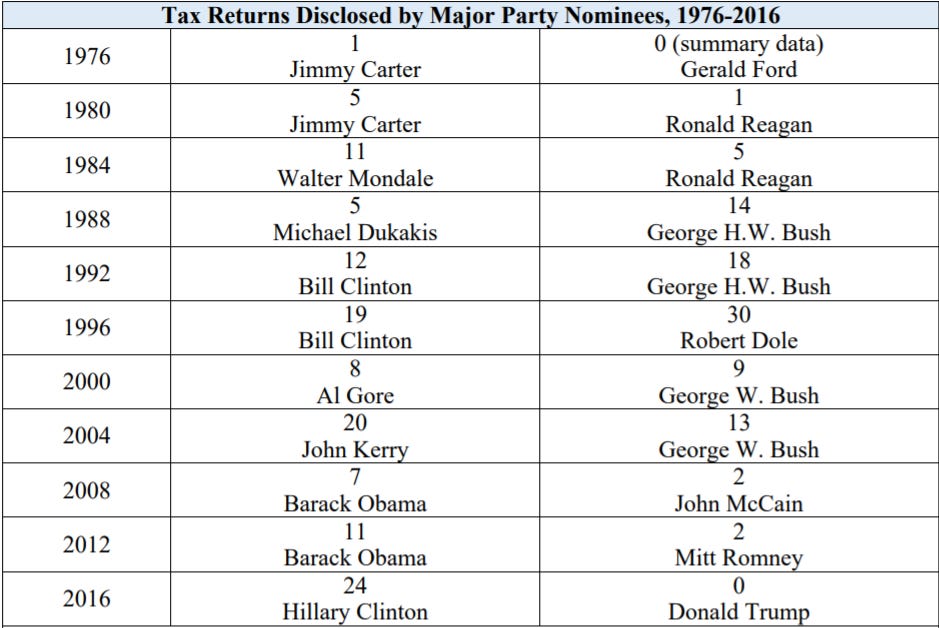

Trump explicitly promised to release his tax returns during his presidential campaign. But he reneged, making him the first president in 40 years to keep his tax returns secret.

Not only is he keeping his tax information secret, but Trump is also the first president in modern history to maintain ownership over his business ventures as president. Who is paying the President of the United States? We have no idea.

The Democrats now control the House Committee on Ways and Means. Under Section 6301(f)(1) of the tax code, the chairman of the House Committee on Ways and Means has an unqualified right to request and receive the tax returns of any individual:

Upon written request from the chairman of the Committee on Ways and Means of the House of Representatives… the [Treasury] Secretary shall furnish such committee with any return or return information specified in such request...

The information must initially be kept confidential but, upon a vote of the committee, can be submitted to the full House of Representatives, making it public.

But 47 days after Ways and Means Chairman Richard Neal (D-MA) took control of the committee, he still has not requested Trump's returns. What gives?

Promises, promises, promises

In February 2015, Trump told radio host Hugh Hewitt that if he ran for president, he would release his tax returns.

HH: Would you release tax returns, though?

DT: I would release tax returns, and I would also explain to people that as a person that’s looking to make money, you know, I’m in the business of making money until I do this. And if I won, I would make money for our country.

In January 2016, Trump announced that his tax returns were "all approved and very beautiful" and that he planned on releasing them "over the next period of time." (Asked for a specific timeline, he said they'd be released "when we find out the true story on Hillary [Clinton]’s emails.")

On May 8, 2016, Trump promised to release his taxes as soon as possible but claimed he had to wait until an audit was completed. "My financials show I'm worth more than $10 billion by any stretch of the imagination. Has tremendous cash. Tremendous cash flow. You don't learn much from tax returns. But I would love to give the tax returns. But I can't do it until I'm finished with the audit," Trump said.

There is no reason that Trump cannot release tax returns that are under audit. The primary risk in releasing tax returns, as Paul Krugman noted, is triggering an audit. If Trump's returns are already under audit, that's not a concern. (Trump's accountants admitted that Trump's returns from 2008 and earlier are no longer being audited.)

Three days later, Trump told the Associated Press that he was unlikely to release his tax returns before the election because "there's nothing to learn from them" and voters weren't interested.

In an ABC interview on May 13, 2016, Trump seemed less enthused about sharing even basic tax information. He refused to answer a question about his effective tax rate. "It's none of your business," he snapped.

In September 2016, Mike Pence said that "Donald Trump and I are both going to release our tax returns." Pence said that Trump would release his tax returns upon completion of an audit.

In October 2016, Eric Trump said his father should not release his taxes because it would be politically damaging.

The Democratic slow walk

On February 27, 2017, Democrats in the House voted unanimously to force the release of Trump's tax returns. The vote came after Congressman Bill Pascrell Jr. (D-NJ) introduced a privileged resolution that would have compelled the Ways and Means Committee to exercise its authority under the tax law. They were only thwarted by Republicans, who then controlled the House.

Among those voting in favor of forcing Trump to turn over his taxes in 2017: Congressman Richard Neal (D-MA).

But now that Neal is chairman of the Ways and Means Committee, he's taking a markedly different approach. "This has to be part of a carefully prepared and documented legal case, and it’s not subject to just whim and the emotion of the moment," Neal said earlier this month, brushing aside calls for him to move swiftly.

As a legal matter, Neal is wrong. The law does not require a "documented legal case." It says the Treasury Secretary "shall" hand the returns over to the Committee upon request.

Some legal scholars argue that the power of the Committee is subject to the "implicit condition found by the Supreme Court that any congressional inquiry must relate to a legitimate legislative purpose." But that bar is easily met in this case. Congress has a clear interest in knowing who is paying the President and how he might be benefiting from legislation and executive actions.

Neal has also not said how many years of returns he might request or whether he would also request returns from Trump's businesses.

The public wants Trump's taxes public

The American people want Trump's taxes released. A Harvard poll in December 2018 found "63% of voters say the incoming Congress should be allowed to obtain and release the President’s tax returns." The public release of Trump's taxes is supported by 86% of Democrats, 64% of Independents, and 35% of Republicans.

Why disclosure matters

Neal did hold hearings on February 7, 2019, to consider whether to request Trump's tax returns. Although the hearings do not seem to have prompted Neal to take action, it did elicit testimony on the importance of making Trump's tax returns public.

Steven Rosenthal, a senior policy fellow at the Tax Policy Center, testified that disclosure is not only necessary as a check on conflicts-of-interest but also to root out foreign entanglements:

Congress must know whether the president and executive branch are acting solely in the national interest—or are influenced by personal interest. The president and executive branch recommend policies to Congress and wield tremendous power over policy through executive actions. Did the president benefit from last year’s tax legislation, or from regulations implementing that legislation? Would the president benefit from his new tax proposals? The answers to these questions might help the Committee evaluate prior or new tax legislation.

In addition, are the president’s trade, tariffs, and sanctions policies potentially influenced by his business interests at home or overseas? A more complete picture of the president’s finances, including the disclosure of foreign accounts and gifts from foreigners (which must be reported on a Form 3520), could help inform the Committee and Congress. Some of the Committee’s findings may be relevant to other committees as well (e.g., Foreign Affairs).

Giving Trump what he wants

Time is on Trump's side.

Treasury Secretary Steven Mnuchin reportedly plans on refusing to comply with any request from Democrats based on "a quagmire of arcane legal arguments." He may not be able to prevent the release of his tax returns, but he would like to delay the release until after the 2020 election.

Will these legal arguments work? Probably not. According to George Yin, a law professor at the University of Virginia, the authority of the Ways and Means Committee is unconditional:

Section 6103(f) does not place any conditions on the exercise of the authority to obtain tax return information by the Ways and Means Committee. Moreover, it provides no basis for the Treasury Secretary to refuse a request. I believe both features were intentional. Since the president at the time had unconditional access to tax returns, Congress wanted to give its committees the same right.

But all legal proceedings take time. The longer Neal waits to request the tax returns, the better chance Mnuchin's reported strategy of delaying the release of the returns until after 2020 will work.

The legislative solution

Democrats have introduced legislation, H.R. 1, that would require all major presidential nominees to release ten years of tax returns. This is a good solution but, as long as Trump is president, it's unlikely to become law.

Thanks for reading!

Upgrade to a paid subscription and get Popular Information four times per week. It's just $6 per month or $50 for an entire year.