The truth about inflation

Tomorrow is Election Day, and inflation is the dominant issue for most voters. According to a CNN poll conducted October 26-31, 51% of voters say the "economy and inflation" is the "most important issue" when deciding how to vote for Congress. Abortion, which ranked second, was cited as the most important issue by just 15% of voters.

In major media outlets, the discussion of inflation has been cast chiefly in political terms, linked to decisions made by Biden. A database search of 47 major U.S. newspapers — including The New York Times, the Los Angeles Times, the Boston Globe, The Wall Street Journal, and USA Today — over the last month found 514 stories that mention inflation in proximity to Biden.

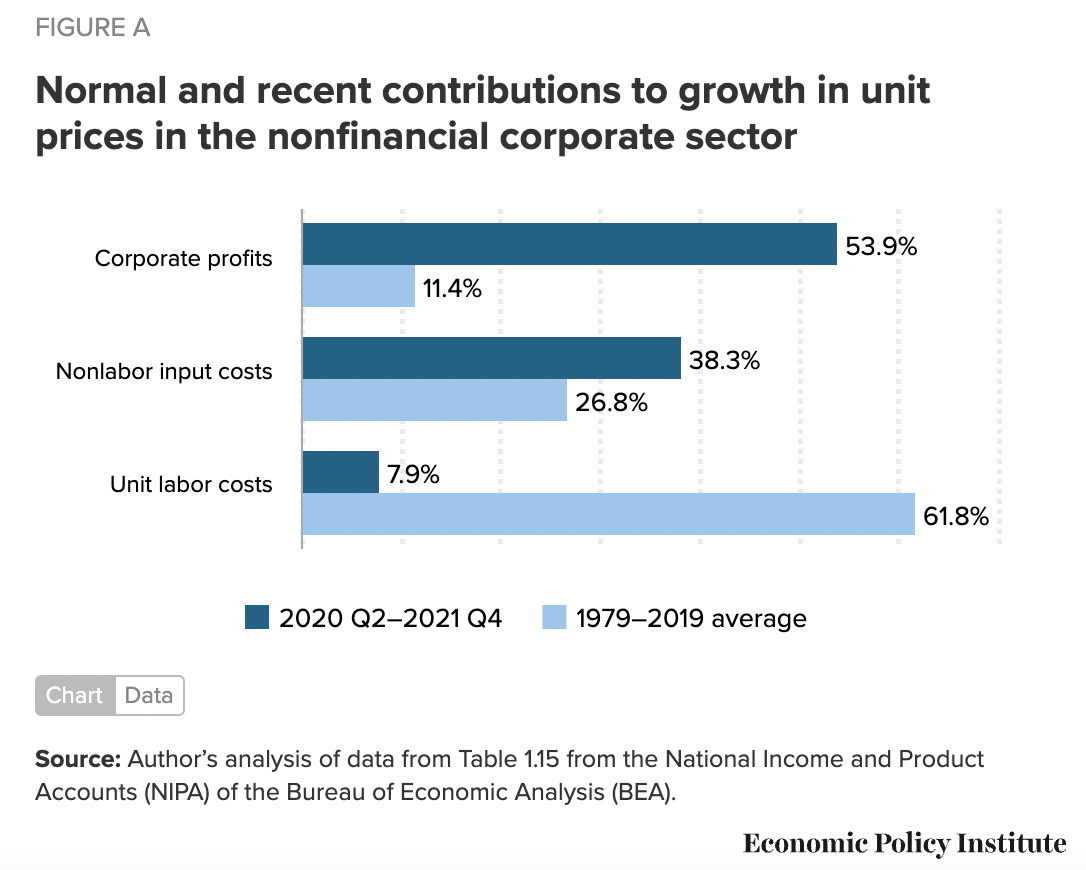

An analysis by the Economic Policy Institute, however, makes clear that corporate profits, not increased costs for labor or inputs, drove the majority of inflation from the start of the pandemic through the end of 2021.

Yet, a search of the same database of major U.S. newspapers over the last month reveals just eight articles that mention inflation in proximity to "corporate profits." Americans are hearing a lot about inflation, but very little about what is driving it.

This isn't to say that corporate profits are entirely responsible for inflation, which stands at 8.2% in the 12 months that ended in September 2022. The pandemic left many people with more cash than normal, creating a spike in demand as normal economic activity resumed in 2021. Other events, like the Russian invasion of Ukraine, continued to disrupt supply chains. But corporate greed is also a major part of the story.

Corporations in highly concentrated industries, with little competition, have been able to exploit the shock of the pandemic and interruptions to the supply chain to massively increase profit margins. A new report by the House Subcommittee on Economic and Consumer Policy demonstrates how some corporations "were able to use their market power to raise prices far above any increases in their underlying costs attributable to existing inflation."

The shipping industry has become highly concentrated. The top 10 container lines "control nearly 85% of the capacity for shipping goods by sea." In the 1990s, "the top 20 companies controlled about half of the global capacity." Even that overstates the amount of true competition today. Currently, nine of the top 10 shipping companies operate "under vessel-sharing agreements called 'alliances' that coordinate schedules and share space on ships." (Shipping companies began joining alliances in 2013.) The shipping industry is exempt from antitrust laws in most countries, including the United States.

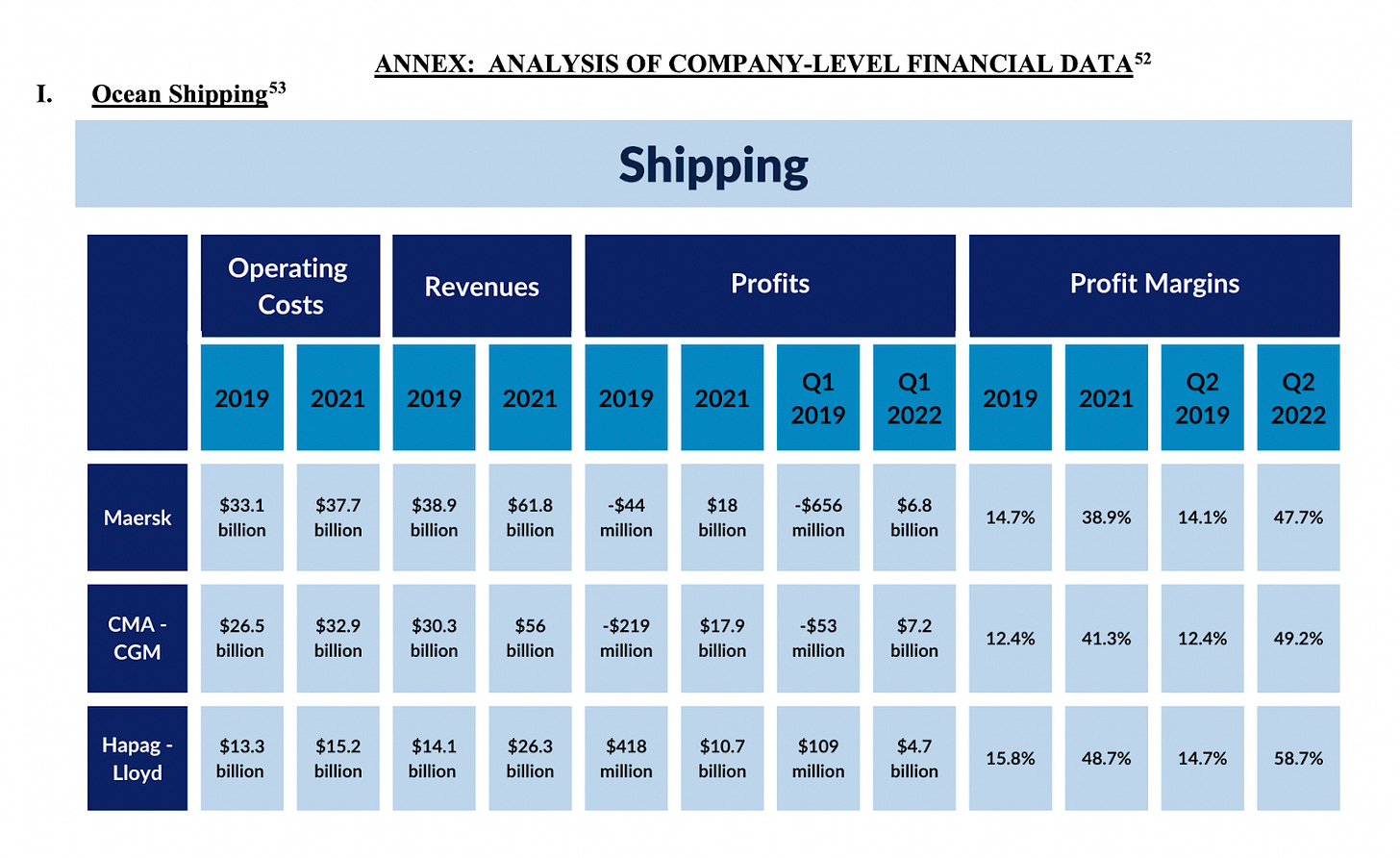

Between 2019 and 2021, "three of the five largest companies in the shipping industry saw profits rise by 29,965%."

Maersk, the second-largest shipping conglomerate, saw its operating costs increase from $33.1 billion in 2019 to $37.7 billion in 2021. But that increase does not explain a massive increase in revenues, which increased from $38.9 billion to $61.8 billion. Its profits increased from essentially zero to $18 billion. The combined profits of Maersk and two other large shipping companies — CMA-CGM and Hapag-Lloyd — increased from $155 million in 2019 to $46.6 billion in 2021. Across the shipping industry, profits were up over 200%.

It's a similar story in other concentrated industries, like rental cars, where three firms control 50% of the market. Between 2019 and 2021, Hertz and Avis "enjoyed a profit increase of 597%," from $244 million to $1.67 billion. Hertz and Avis charged substantially more per transaction even though their expenses went down.

Profits in the oil and gas industry have been eye-popping. In 2021, "four of the ten largest oil and gas companies by market cap with publicly available data reported profits of $70.7 billion in 2021, a nearly 62% increase over 2019 profits." In 2022, profits have been even larger. Over the last six months, "six of the largest oil companies have made more than $100 billion." In the third quarter of 2022 alone, Exxon Mobil recorded $19.66 billion in net profits, the most in the company's 152-year history.

Corporate concentration is not an isolated phenomenon. Over the last two decades, "[m]ore than 75% of U.S. industries have become more concentrated." A paper published by the Federal Reserve Bank of Boston found the "US economy is at least 50 percent more concentrated today than it was in 2005." A Roosevelt Institute study released in June found that "markups and profits skyrocketed in 2021 to their highest recorded level since the 1950s."

The evolving economic consensus

It's been fashionable for many economists, even those who worked for Democratic administrations, to dismiss the contribution of corporate greed to inflation. Jason Furman, chairman of the Council of Economic Advisors for Obama, tweeted this in February:

Furman is now a senior fellow at the Peterson Institute for International Economics (PIIE). In his own work, Furman has attributed inflation primarily to excessive stimulus driving demand. PIIE receives a substantial portion of its funding from major corporations — including Amazon, Chevron, Toyota, PepsiCo, and Shell.

Furman's view, however, is no longer a consensus. Paul Donovan, the chief economist at UBS Global Wealth Management, wrote last week in the Financial Times that corporations have "taken advantage of circumstances to expand profit margins." Attributing price increases solely to supply constraints and demand spikes, Donovan says, is itself fueling inflation by convincing consumers higher prices are warranted. Consumers, Donovan writes, are "buying stories that seem to justify price increases, but which really serve as cover for profit margin expansion."

Lael Brainard, the vice chair of the Federal Reserve, acknowledged last month that the "return of retail margins to more normal levels could meaningfully help reduce inflationary pressures in some consumer goods."

Gosh, who owns the vast majority of newspapers? Corporations. You think Jeff Bozos (deliberately misspelled) wants Amazon's profiteering reported on in the Post? In spite of a massive revenue spike thanks to COVID, Amazon jacked up its Prime fee by about 20%. Gordon Gekko was right, greed is good - - for the 1%.

Thanks to the MSM for helping usher in authoritarianism while "both-sides-ing" every political and economic story. I'm beyond disgusted. Even last night, two days before the election, 60 Minutes was doing another "both sides" piece. I changed the channel to save my cardiovascular system.

Great story...wish it had been written several times and months earlier....I don't understand what's happening with the media and the lack of focus in bringing facts to the forefront. Exhausting fighting politicians, corporations and media! In the absence of wide spread facts and civics in our schools, democracy is dead.