How Trump’s trillion-dollar war machine enriches the 1%

Congress will decide in the coming weeks whether to approve a $1 trillion military budget for 2026.

The House-passed National Defense Authorization Act (NDAA) proposes $893 billion in military spending, while the Senate version proposes $926 billion. Whichever total prevails, the White House plans to add another $119 billion from the One Big Beautiful Bill Act. All told, next year’s pending military budget stands between $1.012 trillion and $1.045 trillion.

Money is policy. Should Congress approve such a historic sum, it would not only enable many of Trump’s dangerous and unjust policies — including military occupations of US cities, the resumption of nuclear weapons testing, and rushing toward wars in Mexico, Nigeria, and Venezuela — it would also trigger a historic redistribution of wealth from the public to private arms companies and their shareholders.

A looming half-trillion-dollar privatization of wealth

More than half of next year’s trillion-dollar Pentagon budget would likely go to private companies. A recent study from Brown University’s Costs of War project found that over half of Pentagon spending from 2020 to 2024 went to for-profit contractors. For Popular Information, I expanded the report’s sample size by another 20 years (I should know how to do this, as I co-authored the Brown study.1) Since 2000, 53% of Pentagon spending has gone to contracts.2 By that figure, the 2026 military budget would likely privatize well over $500 billion in public funds.

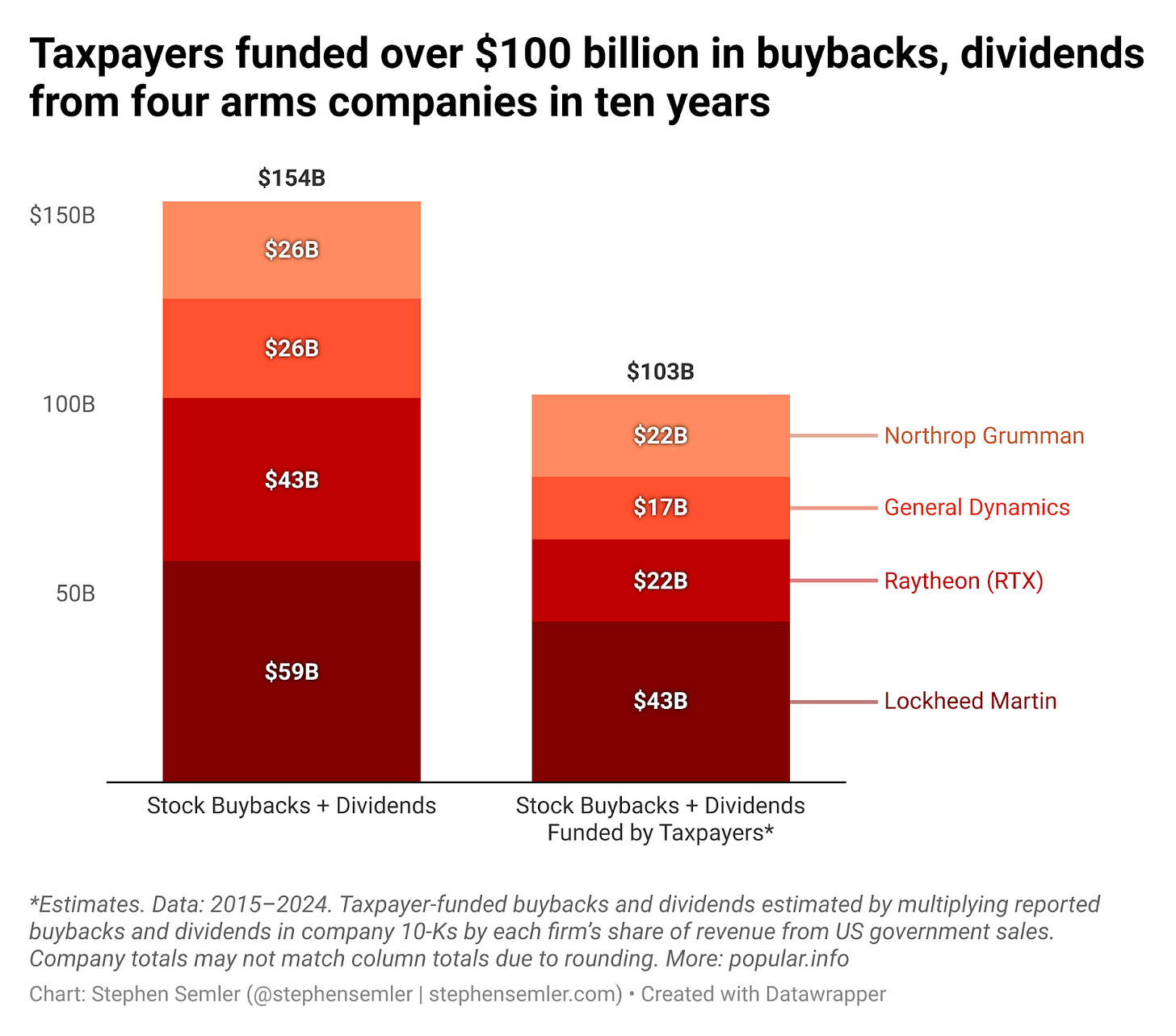

Four military contractors, ten years, $103 billion in taxpayer-funded buybacks and dividends

More than a quarter of next year’s Pentagon contract dollars will likely go to just four companies: Lockheed Martin, Raytheon (now RTX), General Dynamics, and Northrop Grumman.3

A review of each contracting giant’s 10-K filings over the last decade reveals what should be a scandal: Taxpayers are subsidizing arms company shareholders. Based on their share of revenue from sales to the US government, Lockheed Martin, Raytheon (RTX), General Dynamics, and Northrop Grumman used public funds to cover $103 billion in buybacks and dividends over the last decade. US taxpayers covered two out of every three dollars these companies spent enriching their shareholders.4 This is a conservative estimate.5

Two main factors make these billions in shareholder subsidies possible. First, the extent to which these firms rely on public funds. Here’s how much of their 2015–2024 revenue came from US government contracts:

Lockheed Martin: 72%

Raytheon (RTX): 51%

General Dynamics: 64%

Northrop Grumman: 85%

Second, despite these firms effectively being public firms, US political leaders allow them to spend vast amounts of taxpayer dollars rewarding their shareholders. In 2024, each spent an average of $4.3 billion on stock buybacks and dividends — well above the S&P 500 average of $3.1 billion — and collectively paid out $154 billion in buybacks and dividends over the last decade.

Class warfare

To review, it’s likely that more than half of next year’s $1 trillion military budget will be privatized through contracts, over a quarter of those contracts will go to just four firms, and more than one in ten federal dollars these firms receive will go to their shareholders.6

Military spending’s redistribution of wealth produces few winners and many losers. Winners include the top 1%, who own 50% of stocks and mutual funds, compared to the bottom 50%, who own just 1%.

The buybacks and dividends further enrich wealthy shareholders and represent lost wages for arms industry employees. This is part of the reason why, despite surging Pentagon budgets, arms industry salaries are declining — executive pay being the exception.

The working and middle classes will bear the brunt of the trade-offs of the $1 trillion budget itself. To offset the cost of historic levels of military spending, social programs were cut, leaving most Americans worse off.

This is not a sign of a country on the ascent. Rather, it suggests a state in decline and addicted to war, two traits that often go together.

See William D. Hartung and Stephen N. Semler, Profits of War: Top Beneficiaries of Pentagon Spending, 2020–2024, Costs of War at Brown University’s Watson Institute for International and Public Affairs, July 8, 2025.

Disregarding funding and looking only at the share of each year’s budget obligated to contracts, 53% is also the mean, median, and mode over this 25-year period.

From 2015–2024, these four firms received over 26% of Pentagon contract dollars ($981,427,237,126 / $3,763,250,977,116 = 26.1%).

This estimate was calculated by dividing a company’s sales to the US government by its total revenue, then multiplying that share by its spending on buybacks and dividends. This process was conducted 40 times (four firms × ten years).

Revenue from foreign arms sales brokered by the US government, which can also be funded in part by the US government, is accounted for separately in company 10-K reports and is therefore excluded from this analysis.

Estimate based on the share of the four companies’ revenue from US government sales ($57,544,050,287) divided by their total US government sales from 2021–2024 ($570,276,000,000) = 10.1%.

This report should be the lead item on every newspaper in the country and every news program.

Taxpayers subsidizing weapons company stock buybacks worth tens of billions of dollars *should* be a scandal. Sadly, next to the Epstein Files, I think it will get buried. Not that I don't want to see accountability for the rich and powerful, but these sums going to the military-industrial complex are absurd.