UPDATE: Kodak executives' surreptitious profiteering

Thursday's Popular Information examined the unusual $765 million loan from the Trump administration to Kodak. The loan, intended to allow the struggling film company to get into the generic pharmaceutical business, sent Kodak's stocks soaring from $2.11 to nearly $60. (As of this writing, the stock is priced at about $23.) Popular Information report included details on a significant purchase of stock by Kodak CEO Jim Continenza a month earlier when negotiations for the government were underway. Kodak described Continenza's June purchase as "a continuation of ongoing, regular investments in Kodak and are in full compliance with regulatory guidelines for investment activity.”

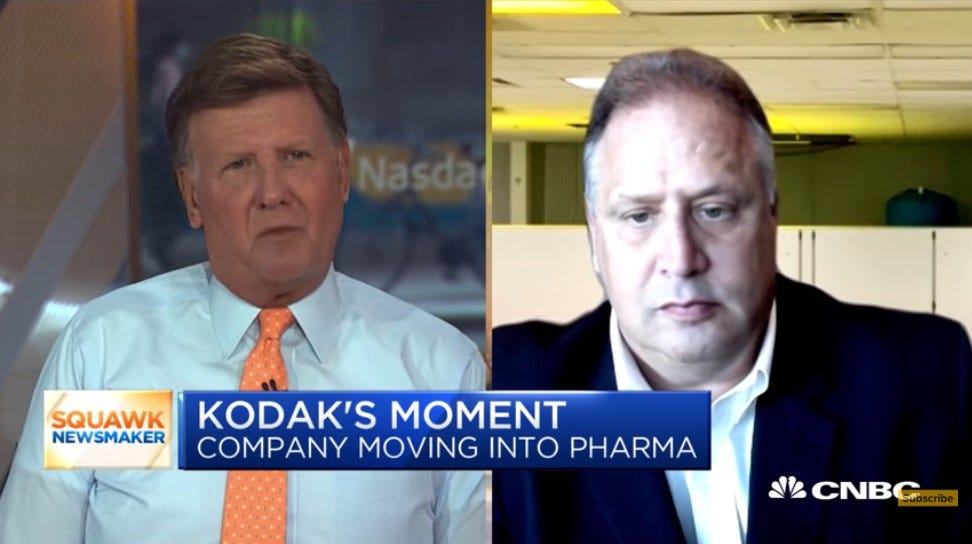

But as the media covered news of the deal, more direct evidence of executive profiteering was being concealed from the public. On July 27, the day before the deal was announced, Kodak awarded Continenza and three other top Kodak executives stock options. Those stock options include the right to buy Kodak stock at $3.03, $4.53, $6.03, and $12 until February 2026. But while the options were awarded on July 27, they weren't disclosed until after 7 PM on July 29. As the Non-Gaap newsletter notes, this means that when Continenza appeared on CNBC and Fox Business about the deal on the morning of July 29, he could not be asked about the transaction.

The primary beneficiary of the option awards was Continenza, who was awarded 1.75 million options. The bulk of those, 981,707 shares, were the option to purchase Kodak stock at $3.03 per share. These options are now worth tens of millions of dollars.

Other beneficiaries include Vice President Randy Vandagriff, General Counsel Roger Bryd, and CFO David Bullwinkle. They received 45,000 options each. But these options are still worth several hundred thousand dollars.

Kodak, in an amendment filed July 30, attempted to claim that Continenza's grant was issued to prevent dilution in his stock holding should a convertible note due in 2021 convert to equity. A convertible note gives a lender the option of taking equity in the company. This is something that is very likely to happen now that Kodak is significantly more valuable.

Kodak's argument is complex but not particularly convincing. There is no reason why Continenza should be protected from being diluted if the note converts. All other shareholders will be diluted. Further, according to Kodak, 28.57% of Continenza's options vest regardless of whether the note is converted to equity. Kodak also said the options were authorized by shareholders in May, but there is no explanation as to why it waited until the day before the announcement with the Trump administration to issue the options.

This argument also does nothing to explain the valuable options that were issued to Vandagriff, Byrd, and Bullwinkle on July 27, the day before the deal was announced.

In normal circumstances, one might be able to argue that executives should be personally rewarding for striking a deal to save a company. But this was not an ordinary loan. It was a loan from taxpayers intended to assist the country's response to a deadly pandemic. Using such a loan as an occasion to personally enrich top executives takes on a different meaning. The efforts they took to keep news of the options out of the initial news cycle suggests they knew what they were doing was wrong.

Thanks for reading!

I want to thank you for clarifying another sleazy transaction by already wealthy CEO’s. Kodak’s greedy, dishonest, (but not totally illegal) transactions to make their top execs richer smells to high heaven! I want my taxpayer loan back!! With interest! And I want these men prosecuted because if what they did is legal, then what’s the point of sending other people to prison for swindling us out of a few thousand dollars. I feel like I’m living in some kind of alternate upside down world where the cheaters just keep benefitting. How and why do they continue to get away with robbing taxpayers?!?!

@Judd have you looked into the Goldman-Sachs one-sided downgrading of Apple stock? It bounced the stock down and not only just before their earnings announcement, but also just before Apple announced a 4 way split which is driving the price up.