What happened before Kodak's moment

Photo by Smith Collection/Gado/Getty Images

Kodak, once an iconic American brand valued at $30 billion, has been in dire straits for more than a decade. It filed for bankruptcy in 2012 and emerged in 2013. But Kodak, which built its business selling film, never successfully transitioned to digital.

After bankruptcy, Kodak's old stock was worthless, but the newly issued shares peaked at over $36 in early 2014. But since then, it has rapidly declined, with the price mired well below $3 since March. In recent years Kodak has been selling its patents, buildings, and other assets for cash. In 2018, the company attempted a pivot to cryptocurrency.

Then, late Tuesday afternoon, everything changed. President Trump announced that he was "using the Defense Production Act to provide a $765 million loan to support the launch of Kodak Pharmaceuticals." Kodak would now "produce generic active pharmaceutical ingredients," reducing the country's reliance on China. Trump described it as "one of the most important deals in the history of U.S. pharmaceutical industries."

The deal was also announced in Kodak's home city of Rochester, with White House adviser Peter Navarro in attendance.

The stock immediately spiked, reaching $53 by 10 AM on Wednesday. To put that in perspective, if you owned 100,000 Kodak shares on Monday morning, they were worth $210,000. By 10 AM on Wednesday, those same shares were worth $5.3 million.

But Kodak's stock actually began to rise before Trump's announcement. On Monday, it increased from $2.15 to $2.62 on an unusually large volume of trading. Kodak CEO Jim Continenza appeared on CNBC's Squawk Box and was asked about the high trading volume on Monday. Continenza said he couldn't explain it.

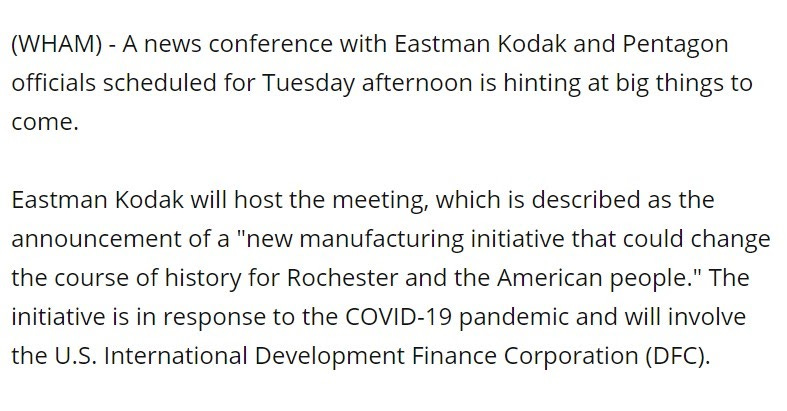

But Popular Information has learned that at least part of the reason for the spike on Monday was carelessness by Kodak. On Monday at 12:02 PM, Kris Betts, a reporter for WHAM, a local Rochester station, tweeted about an impending announcement. Betts, quoting a Kodak press release, said that the announcement would involve U.S. government officials and "could change the course of history for Rochester and the American people."

A couple of hours later, a story with the same information was published to the WHAM website:

Both the tweet and the story were taken down within a few hours without explanation. But WHAM told Popular Information that, on Monday, a Kodak press release was sent by email to Rochester news outlets without any indication that it was "embargoed" until Tuesday. Later, Kodak informed the station that it "forgot" to include the embargo, and WHAM agreed to take the story down. The news was also reported (and later removed) by other local outlets, including WROC.

By Monday evening, a slightly vaguer version of the story was tweeted by The New York Times' Maggie Haberman.

On Tuesday morning, the Wall Street Journal reported that Kodak would receive a loan from the federal government. The stock ended Tuesday at $8.06. After the official announcement, Kodak’s stock price soared.

Kodak did not respond to a request for comment.

Insider purchases

The administration's loan to Kodak was possible because of a May 14 announcement by Trump. That was when Trump delegated authority to the CEO of the United States International Development Finance Corporation (DFC) under the Defense Production Act. The DFC was authorized to invest in companies to "restore the domestic industrial base capabilities, including supply chains within the United States… needed to respond to the COVID-19 outbreak."

During his CNBC appearance, Continenza said that he had been working with the government on securing the loan for "a few months." It is obvious that securing the deal would dramatically increase the value of the company. The amount of the loan was seven times the value of Kodak at the beginning of this week.

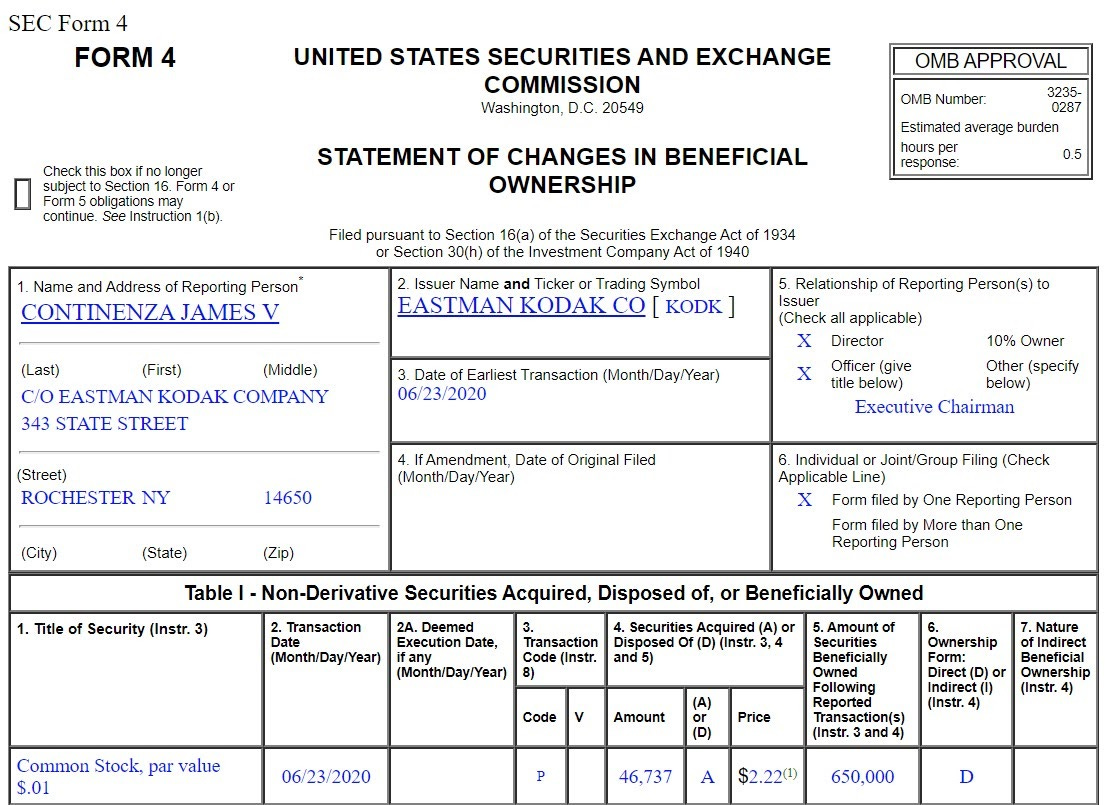

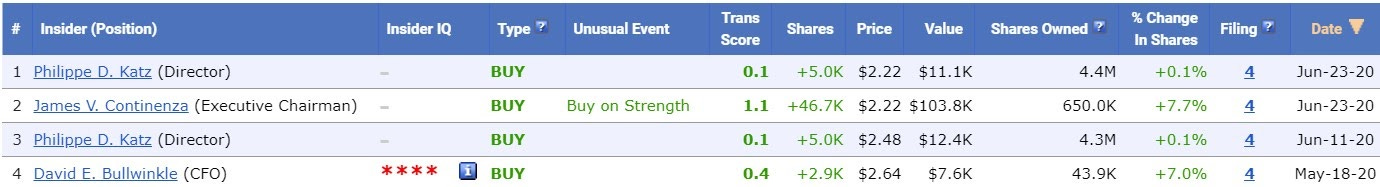

That means that Continenza knew about the possibility of the deal when he purchased 46,737 shares of Kodak on June 23.

At the time of his purchase, those shares were worth 103,756.14. As of Wednesday afternoon, those same stocks were worth $1.87 million.

Other employees who purchased shares since the May 14 announcement include Director Philippe Katz and CFO David Bullwinkle.

Continenza has made a few other purchases of Kodak stock dating back to August of last year. In an appearance on Fox Business on Wednesday, Continenza said he doesn't "speculate on the stock price."

The hydroxychloroquine connection

The deal with Kodak was brokered by White House trade advisor Peter Navarro. In recent days, Navarro has openly feuded with Anthony Fauci, the nation's leading infectious disease expert. Navarro wrote an op-ed for USA Today with the title, "Anthony Fauci has been wrong about everything I have interacted with him on."

One of Navarro's chief complaints is that Fauci was insufficiently supportive of using hydroxychloroquine, an anti-malarial drug, to treat or prevent COVID-19. The deal with Kodak appears to be a way for Navarro to continue to push hydroxychloroquine. As part of the deal, Kodak will reportedly manufacture chemicals that will allow more hydroxychloroquine to be produced domestically.

Studies have shown, however, that hydroxychloroquine is not effective in treating or preventing COVID-19. A study by the University of Minnesota, released June 3, found hydroxychloroquine "does not prevent Covid-19." A rigorous study by the UK government, released June 5, found hydroxychloroquine had "no benefit for hospitalized Covid-19 patients." On June 15, the FDA revoked its emergency authorization for the drug, stating that its "unlikely to be effective in treating COVID-19." The WHO dropped hydroxychloroquine from a large clinical trial on June 17, "after available data indicated the drug was not effective for Covid-19." (Navarro has keyed in on one outlier study that experts say was deeply flawed.)

But, despite the evidence, Trump and his advisers remain keenly interested in the drug. On Tuesday, Trump praised Dr. Stella Immanuel, who claimed in a viral video that hydroxychloroquine is a “cure" for COVID-19. Trump said Immanuel was "spectacular" in the video, adding that he believed hydroxychloroquine "works in the early stages" of the virus.

Immanuel, however, is known for holding a number of views that are not supported by scientific literature, including that "the uterine disorder endometriosis is caused by sex with demons that takes place in dreams."

Thanks for reading!

So, not only an obvious case of insider trading (wonder how much administration people, let alone the Trump family, made on this scheme) but the deal is to manufacture ingredients for a drug that has been shown not to work on the virus.

Grift all around.

So much corruption, so few hours to write about it all. Besides investigating Kodak CEO and other execs for insider trading, I suggest that we review all stock trades by every member of Congress and their staff to see if/who invested in Kodak. The investigation should also include all Cabinet members and White House Staff. And let's not forget all members of the Trump family. It wasn't all that long ago that Republicans were complaining about President Obama picking the winners and losers instead of allowing the free market to do its job. As with so much Republican dogma, guess this is only relevant when a Democrat is president. This deal needs much, much more inspection.