Strategic corruption reserve

President Trump is hawking a memecoin and collecting most of the revenue from the sale of a separate coin from a company called World Liberty Financial. Meanwhile, Trump is plowing ahead with his plan to create a federal "Crypto Strategic Reserve."

It started with an executive order, "Strengthening America's Leadership In Digital Financial Technology," issued on Trump's third day in office. The executive order created a crypto working group tasked with evaluating the creation of a "national digital asset stockpile."

The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts.

Trump expanded on this concept in a post on Truth Social on Sunday. He specified that the "Crypto Strategic Reserve" would not only contain well-known tokens like Bitcoin (BTC) and Ethereum (ETH), but also newer entrants like XRP, Solana (SOL), and Cardano (ADA).

The term "Crypto Strategic Reserve" is a non sequitur since there are no plausible circumstances in which the United States government holding large amounts of cryptocurrencies would be of any strategic benefit.

A strategic oil reserve is beneficial in the event of a shortage of oil imports or a disruption in domestic oil production. When would a reserve of cryptocurrency be useful? Under what circumstance would the United States need to make a transaction with a crypto token that could not also be made with the dollar?

It raises the question of why the United States would divert taxpayer resources to obtain these tokens.

While the public benefit is unclear, the biggest economy in the world buying up large amounts of various crypto tokens would be a financial windfall for the companies that created these tokens and the people who already own them. Those companies and investors also have close political and financial ties to Trump.

Ripple makes waves

For XRP, being included in Trump’s proposed national crypto reserve is a major coup for its creator, Ripple.

Introduced in 2012, XRP is the world’s third-largest cryptocurrency and was designed to speed up international transactions by using XRP as a bridge currency for transactions made through Ripple’s payment network. Most of the large financial institutions that use Ripple's platform, however, do not use XRP, so the currency has little value other than as a speculative asset. The currency remains highly centralized, with Ripple owning 48 billion XRP of the 100 billion coins in circulation.

In December 2020, the end of Trump’s first term, the SEC issued charges against Ripple related to XRP, alleging that the token was an unregistered security. Initially a court ruled that XRP is a security in certain transactions but not in others, but the SEC appealed that decision. Although the SEC has abandoned many of its other legal actions against crypto firms, the appeal in the XRP case is still pending.

Ripple's improving political fortunes is not an accident. The company contributed $5 million worth of XRP to Trump’s inauguration fund, one of the largest corporate contributions. Ripple also donated $45 million dollars to Fairshake, a Super PAC that supported pro-crypto congressional candidates and played a critical role in securing Republican majorities in the House and Senate. The company has since contributed another $25 million to Fairshake ahead of the 2026 midterm elections.

Ripple CEO Brad Garlinghouse attended Trump’s inauguration and earlier in January, he and Ripple’s chief legal officer had dinner with Trump at Mar-A-Lago. The New York Post reported that Garlinghouse is on the shortlist of candidates for Trump’s crypto advisory council.

Garlinghouse praised Trump’s inclusion of smaller and more volatile cryptocurrencies like XRP in the national crypto reserve on X.

We started a new publication, Musk Watch. NPR covered our launch HERE. It features accountability journalism focused on one of the most powerful humans in history. It is free to sign up, so we hope you’ll give it a try and let us know what you think.

Trump's selections mirror investments by Trump's crypto czar

David Sacks is a venture capitalist and Trump fundraiser, who was named Trump’s crypto czar. Trump's selections for the "Crypto Strategic Reserve" closely track Sacks' investments in the industry.

On Sunday, Sacks posted on X that he sold all of his cryptocurrency “prior to the start of the administration.”

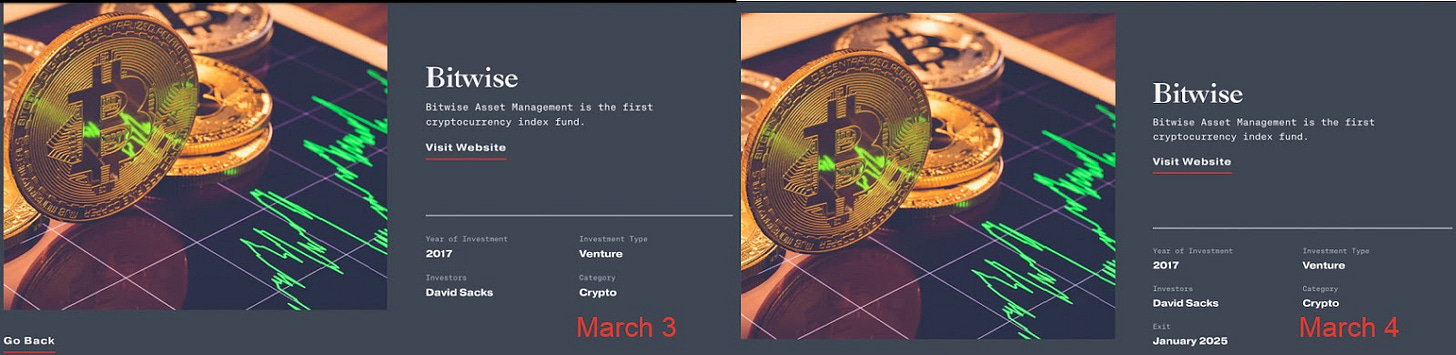

But Sacks has not yet disclosed his investments in companies involved in the crypto industry. And Sacks’ venture firm, Craft Ventures, has invested in several crypto start-ups, including Bitwise Asset Management.

Craft Ventures invested in Bitwise, a company that sells crypto index funds, in 2017. Sacks is listed as the primary investor. Bitwise’s top holdings match the five holdings named by Trump for the "Crypto Strategic Reserve." Including those holdings in the reserve will likely increase the value of and interest in Bitwise's index funds.

As recently as Monday, according to archive.org, the Craft Ventures website listed Bitwise as an active investment. But, after the investment in Bitwise drew criticism, the website was updated this week to say Craft Ventures "exited" its investment in January 2025. Neither Sacks nor Craft Ventures disclosed who purchased his stake or the terms of that sale.

Further, on March 2, after Trump's announcement, Sacks wrote "correct" in response to an article in the Financial Times that stated Sacks "retains stakes in a small number of crypto start-ups." In addition to Sacks' investment through Craft Ventures, Sacks reportedly was a seed investor in Bitwise.

CoinDesk reported that Sacks is “a limited partner of Multicoin Capital,” which has major investments in Solana, another token that Trump chose for the reserve. After facing backlash, Sacks wrote on X that he “sold Multicoin too.” Sacks did not clarify when he sold his interest in Multicoin Capital or the terms of the sale.

Sacks posted on X that he does not have “large indirect holdings” in crypto, and will “provide an update at the end of the ethics process.”

Trump himself could also benefit through the bolstering of the Solana protocol, which hosts most memecoins. In January, Trump and his wife Melania both launched their own memecoins on Solana. Including Solana in a crypto reserve may benefit the Solana network and, as a result, boost the value of Trump’s memecoin.

I’ll admit to being totally clueless here, except about one point:

Trump is, yet again, using the Presidency to enrich himself and the big money grifters who pay him, all at the expense of the American people.

The trump/musk/vance regime is a corrupt enterprise. At this point they don’t even try to hide the corruption, instead it is on open display every day. In this way, they are acclimating the American people to the corruption by treating it as a normal process.

Crypto has been appealing to many because it works outside the bounds of normal government regulation. And now this corrupt government wants to give crypto a sheen of legitimacy. This whole scheme will work to enrich the few at the expense of the many.